DOW AND S&P 500 GREEN FOR 2016

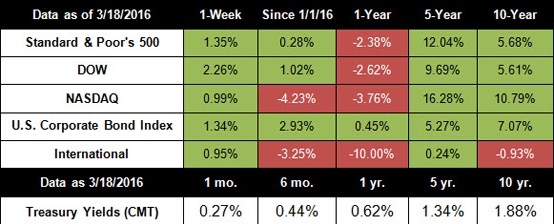

After a historically rough start to the year, stocks finally rallied enough to put the S&P 500 and Dow in the green for the year. Extended weakness in the dollar-which investors hope could boost economic growth and corporate profits-contributed to the gains.[1] For the week, the S&P 500 rose 1.35%, the Dow added 2.26%, and the NASDAQ grew 0.99%.[2]

The last two weeks have been important in terms of global monetary policy. The European Central Bank, Bank of Japan, and Federal Reserve all met to determine next steps for their respective economic spheres of influence. Currently, there is a divide between the Fed, which is moving away from low rates while supporting economy growth, and the ECB and BOJ, which are fighting slowing economic growth with negative rates and quantitative easing. However, the latest Fed meeting suggests that the divide may not be as great as it was before.

The Fed voted last week to hold rates steady, not being ready to commit to further increases at the moment. However, the central bank’s official statement indicated that we can expect two interest rate hikes this year, instead of the four projected in December. The statement makes it clear that the Fed is adjusting its expectations to a slow-growth, slow-inflation world, which brings it more in line with the concerns of other central banks.[3]

The Bank of Japan also voted to hold rates steady at the current negative 0.1% level last week; however, official notes from the January meeting showed that central bankers also debated expanding asset purchases to further stoke growth.[4] The move into negative interest rates by the ECB and BOJ-essentially charging depositors for the privilege of holding cash-is worrying to some. Some economists fear competition between central banks to lower rates (potentially triggering a currency devaluation war) as well as the effect of negative rates on bank profits.[5]

One big question on everyone’s mind is this: Does the Fed have enough bullets left to respond to an economic slowdown?

After seven years of ultra-low rates, the Fed can’t push rates much lower without going into negative territory. Though Fed chair Janet Yellen has stated that negative rates aren’t off the table in the event of a slowdown, it’s clear that the Fed isn’t keen on the idea.[6]

Former chair of the Federal Reserve Ben Bernanke waded into the fray last week with a blog post supporting a “balanced monetary-fiscal response” to a potential downturn. In his ideal scenario, the best response to an economic slowdown would combine further quantitative easing and interest rate decreases with fiscal policies like increased government spending.[7]

Bernanke’s support for accommodative fiscal policy isn’t new; in the past, he has rebuked Congress for not doing enough (in his opinion) to stoke economic growth.[8] Leaving the politics of government spending firmly aside, here’s what we can take from Bernanke’s remarks: The Fed is taking threats of a slowdown seriously and may still have enough tools in the toolbox to fight a downturn if it comes.

Is a downturn likely? We can’t say. Predicting a recession is always difficult, and the probabilities of a recession this year are all over the place. A Wall Street Journal poll of economists has the current probability at 20%, down from 21% last month.[9] The Federal Reserve Bank of Atlanta sees the risk as much lower-just 10%.[10] Yet another prediction has the odds at just 4.06[11] Basically, no one knows for sure.

In the week ahead, investors will be watching currency prices to see if the dollar continues its downward trajectory. If investors believe the dollar has peaked in value, it could give markets enough confidence to extend the rally further.

ECONOMIC CALENDAR:

Monday: Existing Home Sales

Tuesday: PMI Manufacturing Index Flash

Wednesday: New Home Sales, EIA Petroleum Status Report

Thursday: Durable Goods Orders, Jobless Claims

Friday: GDP

Notes: All index returns exclude reinvested dividends, and the 5-year and 10-year returns are annualized. Sources: Yahoo! Finance, S&P Dow Jones Indices, and Treasury.gov. International performance is represented by the MSCI EAFE Index. Corporate bond performance is represented by the SPUSCIG. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Retail sales revised downward in January. Retail sales slumped in February as expected; however, a sharp downward revision in January sales- from a 0.2% increase to a 0.4% decrease- could be a sign of trouble.[12]

Housing starts rebound in February. Groundbreaking on new home construction surged more than expected last month as U.S. homebuilders invested heavily in single-family homes. The rise is a strong sign of confidence in the economy.[13]

Consumer sentiment dips in March. A measure of optimism about the economy among Americans fell slightly this month as consumers felt the effects of rising gasoline prices and worried more about the economy.[14]

Job openings rise in January. Job openings rose to 5.5 million in January, up from 5.28 million in December, though the hiring rate dipped slightly. Increased openings are a positive sign for the economy and show that the labor market is in stable territory.[15]

These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Diversification does not guarantee profit nor is it guaranteed to protect assets.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

The Dow Jones Corporate Bond Index is a 96-bond index designed to represent the market performance, on a total-return basis, of investment-grade bonds issued by leading U.S. companies. Bonds are equally weighted by maturity cell, industry sector, and the overall index.

The S&P/Case-Shiller Home Price Indices are the leading measures of U.S. residential real estate prices, tracking changes in the value of residential real estate. The index is made up of measures of real estate prices in 20 cities and weighted to produce the index.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Google Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

- www.foxbusiness.com

- http://finance.yahoo.com

http://finance.yahoo.com

http://finance.yahoo.com - http://www.cnbc.com/

- http://www.marketwatch.com

- http://www.cnbc.com

- http://www.cnbc.com

- http://www.brookings.edu

- http://thehill.com

http://www.cnbc.com - http://projects.wsj.com

- https://www.frbatlanta.org/

http://www.econbrowser.com/ - https://research.stlouisfed.org

- http://www.foxbusiness.com

- http://www.foxbusiness.com

- http://www.foxbusiness.com

- http://www.cnbc.com